After attempting an Assessment Review Board appeal, I was concerned as to how our Tax System works here in Ontario. I did a simple request to our MPP office and the attached document is what I received back. It shows that there are four main groups that are involved in supposedly getting a fair assessment of our property. They include the Municipality, the Municipal Property Assessment Corporation, the Ontario Government and the Assessment Review Board of Ontario.

MPAC is a level 4 Crown Corporation. Several Municipal councillors have told me that they know that MPAC is broken and there is nothing they can do about it because MPAC is an independent corporation. MPAC has a monopoly on creating all the tax assessments in the Province of Ontario that includes over 5,000,000 properties.

A recent review of the MPAC website shows a Board of Directors of only 13 members with the Municipalities having the majority vote on the Board. As well this attachment shows that the Municipalities are shareholders in MPAC as well. Also, there is no reference as to how the Taxpayer Representatives relate to concerns of the taxpayers in Ontario. It does not show that the taxpayers’ representatives are responsible for representing any group of taxpayers. Are they just representing themselves?

In addition, to being shareholders in MPAC, the municipalities pay the bill for MPAC doing the property assessments through an upper tier County Administration except for larger cities. In our county the treasurer was asked if the bill from MPAC was correct; however, she said she had no way of knowing whether it was correct or not before the bill was divided amongst the Municipalities. As well very few people are aware that MPAC is paid for their services based on 50% of the bill being for the number of assessments completed and 50% on the size of the assessments completed.

This shows a motivation that the shareholders & MPAC could prefer a larger assessment so that Councillors would be able to use a lower mill rate.

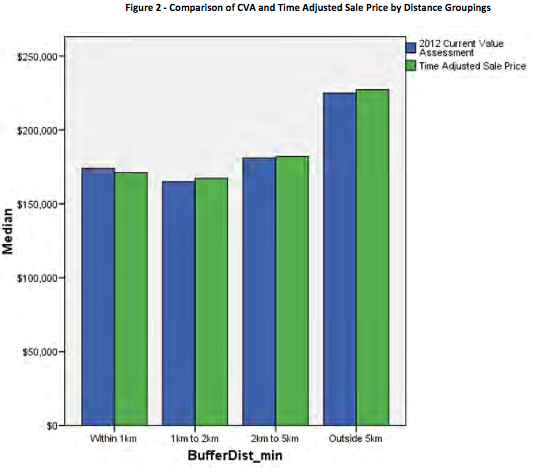

The MPAC study in 2012 regarding the effects of wind turbines on property values shows in a chart on page 18 that there would be a property assessment devaluation of approximately 25% for properties that have at least one turbine under 5km to their property. Many townships with an industrial wind project would have most of their properties within 5km. Neighbouring Twps. would be affected as well.

A researcher for the MPAC study that I contacted stated that everyone (including the MPAC executive) missed the fact that the chart on page 18 was included in the report. He stated MPAC should not have left the chart in the study report for the public to see. Would councillors be willing to approve an increased mill rate of 25% while the project was proposed and built and operated (20-50 years or more}? Would the councillors be re-elected. Is it surprising that the conclusion of the study and the media states that Wind Turbines do not affect property values? Why does the conclusion of the MPAC report not reflect their findings?

After reviewing my Research Information and attending several ARB (Assessment Review Board) hearings. I checked into the definition of a Cartel. This is only a beginning of issues I found and the questions that need to be asked as to whether our TAX SYSTEM in Ontario is broken? Is it a CARTEL???

Cartel Definitions

Historical:

A cartel is a coalition or cooperative arrangement between political parties intended to promote a mutual interest.

- 1) an arrangement among supposedly independent corporations or national monopolies in the same industrial or resource development field organized to control distribution, to set prices, to reduce competition, and sometimes to share technical expertise.

A combination of producers of any product joined together to control its production, sale, and price, so as to obtain a Monopoly and restrict competition in any particular industry or commodity. Cartels exist primarily in Europe, being illegal in the United States under ANTITRUST LAWS.

Does the Ontario Tax System meet the definition of a Cartel. Is it LEGAL, LAWFUL, UNLAWFUL or ILLEGAL???

Dave Hemingway, Reporter for The Landowner Voices