The Ontario Tax System – A Report for Landowner Voices by Dave Hemingway

- 2020-07-01

- By admin

- Posted in Latest News

After attempting an Assessment Review Board appeal, I was concerned as to how our Tax System works here in Ontario. I did a simple request to our MPP office and the attached document is what I received back. It shows that there are four main groups that are involved in supposedly getting a fair assessment of our property. They include the Municipality, the Municipal Property Assessment Corporation, the Ontario Government and the Assessment Review Board of Ontario.

MPAC is a level 4 Crown Corporation. Several Municipal councillors have told me that they know that MPAC is broken and there is nothing they can do about it because MPAC is an independent corporation. MPAC has a monopoly on creating all the tax assessments in the Province of Ontario that includes over 5,000,000 properties.

A recent review of the MPAC website shows a Board of Directors of only 13 members with the Municipalities having the majority vote on the Board. As well this attachment shows that the Municipalities are shareholders in MPAC as well. Also, there is no reference as to how the Taxpayer Representatives relate to concerns of the taxpayers in Ontario. It does not show that the taxpayers’ representatives are responsible for representing any group of taxpayers. Are they just representing themselves?

In addition, to being shareholders in MPAC, the municipalities pay the bill for MPAC doing the property assessments through an upper tier County Administration except for larger cities. In our county the treasurer was asked if the bill from MPAC was correct; however, she said she had no way of knowing whether it was correct or not before the bill was divided amongst the Municipalities. As well very few people are aware that MPAC is paid for their services based on 50% of the bill being for the number of assessments completed and 50% on the size of the assessments completed.

This shows a motivation that the shareholders & MPAC could prefer a larger assessment so that Councillors would be able to use a lower mill rate.

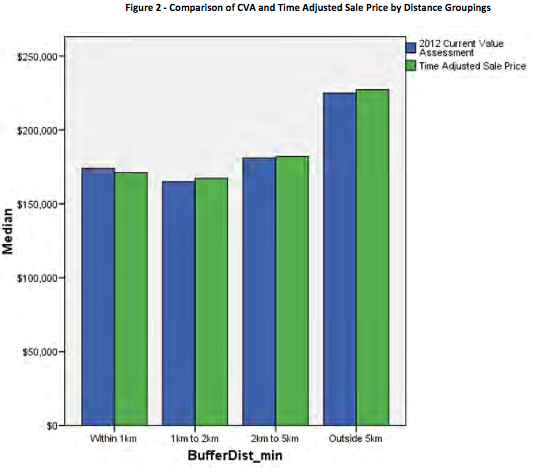

The MPAC study in 2012 regarding the effects of wind turbines on property values shows in a chart on page 18 that there would be a property assessment devaluation of approximately 25% for properties that have at least one turbine under 5km to their property. Many townships with an industrial wind project would have most of their properties within 5km. Neighbouring Twps. would be affected as well.

A researcher for the MPAC study that I contacted stated that everyone (including the MPAC executive) missed the fact that the chart on page 18 was included in the report. He stated MPAC should not have left the chart in the study report for the public to see. Would councillors be willing to approve an increased mill rate of 25% while the project was proposed and built and operated (20-50 years or more}? Would the councillors be re-elected. Is it surprising that the conclusion of the study and the media states that Wind Turbines do not affect property values? Why does the conclusion of the MPAC report not reflect their findings?

After reviewing my Research Information and attending several ARB (Assessment Review Board) hearings. I checked into the definition of a Cartel. This is only a beginning of issues I found and the questions that need to be asked as to whether our TAX SYSTEM in Ontario is broken? Is it a CARTEL???

Cartel Definitions

Historical:

A cartel is a coalition or cooperative arrangement between political parties intended to promote a mutual interest.

- 1) an arrangement among supposedly independent corporations or national monopolies in the same industrial or resource development field organized to control distribution, to set prices, to reduce competition, and sometimes to share technical expertise.

A combination of producers of any product joined together to control its production, sale, and price, so as to obtain a Monopoly and restrict competition in any particular industry or commodity. Cartels exist primarily in Europe, being illegal in the United States under ANTITRUST LAWS.

Does the Ontario Tax System meet the definition of a Cartel. Is it LEGAL, LAWFUL, UNLAWFUL or ILLEGAL???

Dave Hemingway, Reporter for The Landowner Voices

Search:

Categories

Archives

- April 2024

- January 2024

- December 2023

- November 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- June 2013

- April 2013

- October 2012

- May 2012

- September 2011